How it Works

From preparing and negotiating your settlement to liaising with your lawyer, we’ll provide you with the strategic support you need to achieve your desired outcomes.

Getting Prepared

Your first step is to contact us. We’ll then set up a time for an initial consultation and outline what you’ll need to prepare so we can organise a financial pack for you. This pack includes assets, liabilities, statements of accounts, loans and investments ready for a lawyer. We search for any holes in the information to ensure we have a full summary of the assets pool.

The information we typically require at this stage includes:

Assets & Liabilities

- Bank and credit card statements

- Mortgage statements

- Personal loan documents

- Family trust information

- Superannuation statements

- Shares

- Investment property details

- Details of other investments (eg. managed funds, shares)

- Details of other significant assets (eg. art collections)

Income & Expenses

- Pay slips for the both of you

- Tax returns

- Business tax returns

- Insurance policy details

- Employment benefits such as incentive schemes*, share schemes etc .

Choosing the right lawyer

If you need, we can recommend a family lawyer. Our team can compile and present a shortlist of reputable family lawyers who suit your needs and budget.

Using our well-established industry connections, we partner with lawyers who specialise in a range of areas – including complex financial affairs, young children, domestic violence and financial or emotional abuse.

Understanding and Negotiating Settlement options

In order to help you negotiate the best settlement we will take you through the following steps:

1. Build you a financial Model

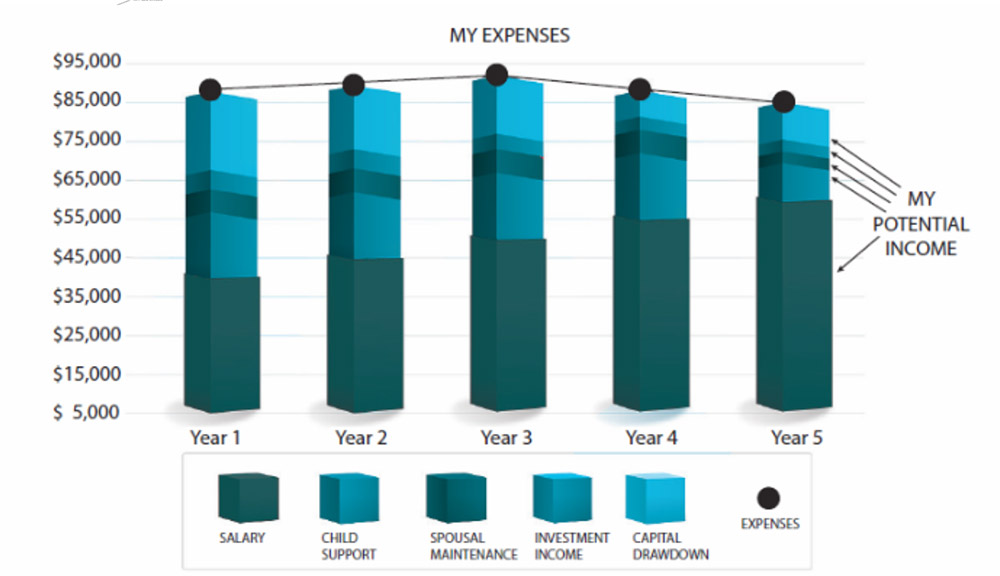

Once your lawyer has provided us with your estimated entitlement (e.g. 55-65%), we'll prepare a financial model to help you understand your economic situation after settlement.

This process will give you the answers to the following questions:

- Will I be able to stay in the family home?

- How much will I need to buy a new home if required?

- How will I fund my cost of living (e.g. everyday expenses, school fees)?

- Will I be financially secure over the long term?

2. We’ll create an appropriate settlement structure

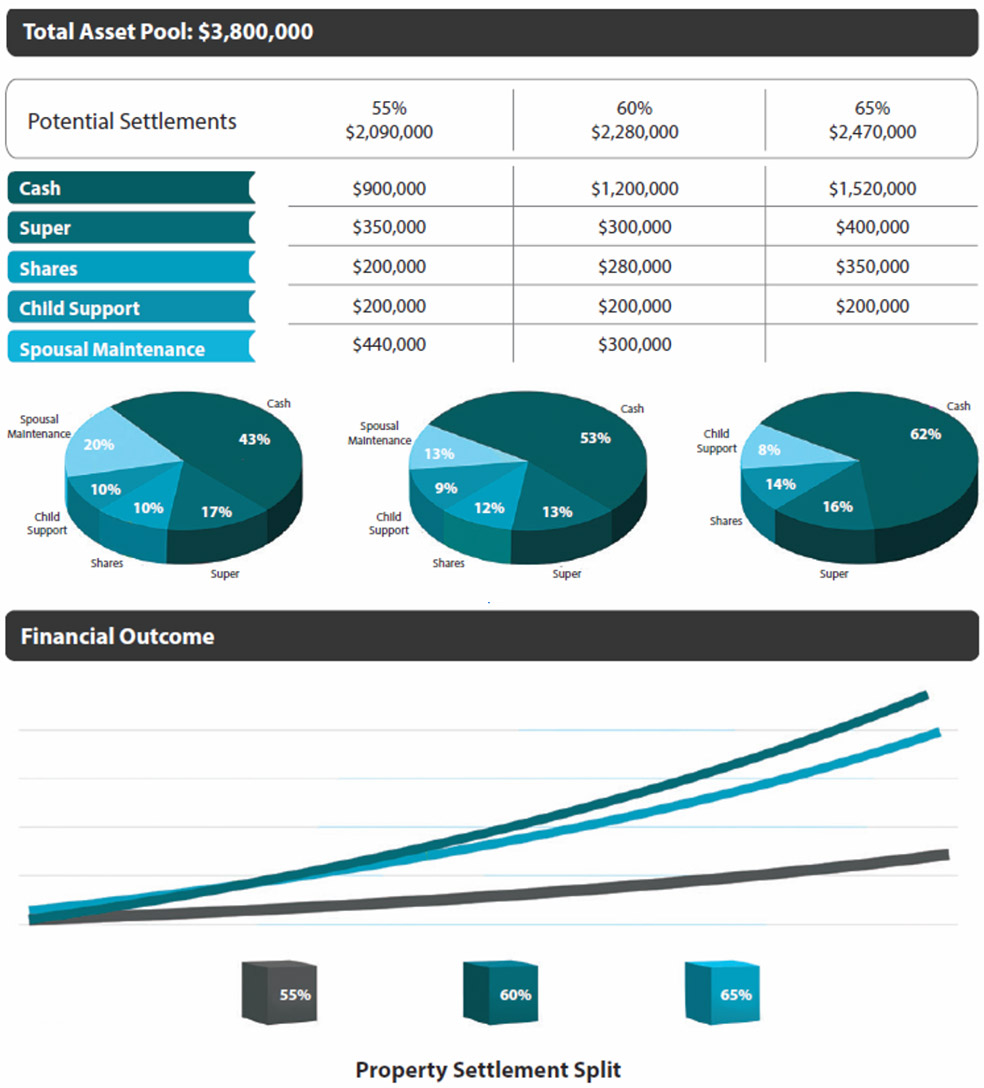

Here, we’ll use our expertise to identify which asset split is best for you. In most cases, splitting assets evenly won’t necessarily result in the fairest outcome. Take the example across.

As you can see, the 60% split ensures the client has the required cash flow and lump sum amount to achieve their short-term objectives, while creating a better long-term financial outcome.

Once we’ve identified the best strategy, we’ll prepare a brief for your solicitor outlining your ideal settlement

3. Negotiating the settlement

During the mediation or negotiation process, you’ll be presented with several settlements. With your lawyer’s input, we’ll help you assess each offer to achieve your ideal outcome.

4. Post settlement

Following settlement, we’ll prepare a full financial plan which outlines all the steps and strategies you need to secure your future.